Maximum amount you can borrow mortgage

Mortgage Calculators. The one trade-off for getting a 0 down payment mortgage is that when you get these loans youll have to pay the VA funding fee.

What Does Your Mortgage Payment Consist Of A Mortgage Payment Is Typically Made Up Of Four Components Principal Mortgage Payment The Borrowers Loan Amount

For PLUS Loans the maximum amount you can borrow is the cost of attendance minus any other funding you receive.

. Interest rate and payment may increase after the initial rate period of 7 years. The maximum loan amount is the highest limit amount that a lender can allow an applicant to borrow. To access the maximum loan amount a borrower must have a good credit history and a higher credit score.

The mortgage should be fully paid off by the end of the full mortgage term. This page allows you to look up the FHA or GSE mortgage limits for one or more areas and list them by state county or Metropolitan Statistical Area. Clifton Private Finance will find you the best mortgage offer youre eligible for.

With a capital and interest option you pay off the loan as well as the interest on it. By default the table lists refinancing rates though you can click on the Purchase heading to see purchase money mortgages. We have the product information you need right across the mortgage market and well get you the best mortgage offer that could be available to you.

Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any. A way to receive reverse mortgage proceeds in which the borrower gets access to a line of credit as well as equal monthly payments for as long as he or she lives in. Similar to the 504 this maximum SBA loan amount is calculated by backing into an amount higher than 5 million based on the amount of the SBA guaranty.

Yes your mortgage rate can change after you get preapproved. Note that this not an official estimate. Buying a home always means.

There are two different ways you can repay your mortgage. During the underwriting process lenders approve the maximum loan amount by evaluating borrowers credit history and debt-to-income ratio. Current Redmond Mortgage Refinance Rates on a 260000 Fixed-rate Mortgage.

You can use the mortgage payment calculator in three ways. If you take out a. However the lender must provide compensating factors if the total debt ratio is more than 41 percent.

Mortgagesie 01 832 7250. With an interest only mortgage you are not actually paying off any of the loan. VAs residual income guidelines ensure Veteran borrowers can afford the loan and determine how much money a Veteran must have left over after all debts and.

Myth 3 Banks only lend up to 70 of your DSR. It can be tempting to borrow the maximum amount you can afford. Based on our calculator if you apply for a mortgage with your spouse a lender may grant you a mortgage amount between 211600 to 306600.

And you dont have to borrow the maximum amount. Give us a call to arrange a suitable time to talk through what you need. Using a percentage of your income can help determine how much house you can afford.

Estimate the maximum amount you are likely to be able to borrow based on your personal circumstances. You can borrow a minimum of 5 and a maximum of 20 40 in London of the propertys full price. There is no maximum debt ratio.

But in some cases that amount may be too generous. So in this example the amount of equity you can access without incurring LMI would be 260000. This is a one-time fee that helps to cover the cost of the VA loan program.

Other types of funding include grants scholarships. However the higher the amount you borrow the less wiggle room youll have in case. If the same 320000 loan above has a 4 rate then youll pay 12800.

You may notice that if you stretch the loan term out over a longer period for example from 20 years to 30 years it might mean you can borrow more however it will increase the total amount of interest you will end up paying across the life of the loan. Mortgage Calculator- How much can you borrow. Use our mortgage calculator to calculate your maximum mortgage with ABN AMRO in 2022 and get instant information on how much you can borrow.

How much can I borrow. 80 of the propertys market value 560000 this is the maximum you can borrow without incurring LMI Remaining balance on loan 300000 this is the amount you have already borrowed 560000 - 300000 260000. Myth 2 The maximum loan amount you can get from each bank doesnt vary much.

They are for the high-price county. The results page will also include a Median Sale Price value for each jurisdiction. As a requirement you must make a 5 deposit and obtain a.

Maximum borrowing amounts can even differ up to 3x between different banks. Capital and interest or interest only. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan.

This calculator gives you an estimate of the maximum amount you will be able to borrow. If you are considering buying a property you can use our mortgage calculator to see how much you could borrow and what the costs might be whether youre. If you have no deposit and need to borrow the full amount otherwise known as needing a 100 LTV - mortgage you can still get a loan but your options will be much more limited than if you had a.

The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt. There is no maximum loan amount. Those are the median price estimates used for loan limit determination.

If you have student debt and are planning to buy a house the amount you can borrow on a mortgage will be lower because you have to be able to continue your monthly student debt payments as well. 5 maximum interest rate. There are enough exceptions to say that credit policies can differ greatly from one bank to another.

If you are deemed a qualified borrower a lender is prone to approve you for the maximum it believes you can afford. By combining the flexibility of a construction loan with a traditional mortgage loan you can save on the fees and closing costs of two loans. How much house can I afford.

The following table highlights current Redmond mortgage rates. And if rates are volatile at the time it might change by quite a lot. The amount of interest youll pay to borrow the principal.

Modified Tenure Payment Plan. Then multiply that number by four to see the maximum amount you can borrow without having to make a down payment. These can run about 2-5 of your loan amount and will need to be paid upon closing.

The maximum SBA loan guaranty to any business is 375 million and for most lenders this equates to a maximum loan amount of 5 million because if you divide 375 million by 75 because. For example the 2836 rule may help you decide how much to spend on a home.

Investing Calculator Borrow Money

12 Things Canadians Don T Know About Second Mortgages Canadian Mortgages Inc

Decoding The Factors That Determine Your Credit Score Infographic Daily Infographic Credit Score Infographic Credit Repair Credit Card Infographic

Infographic 10 Steps To Buying A Home In The Uk Home Buying Infographic 10 Things

Tips For Repaying Your Payday Loan Payday Loans Payday Best Payday Loans

Pin On Ontario Mortgage Financing

Private Mortgage Lenders Toronto Mortgage Lenders Lenders Mortgage

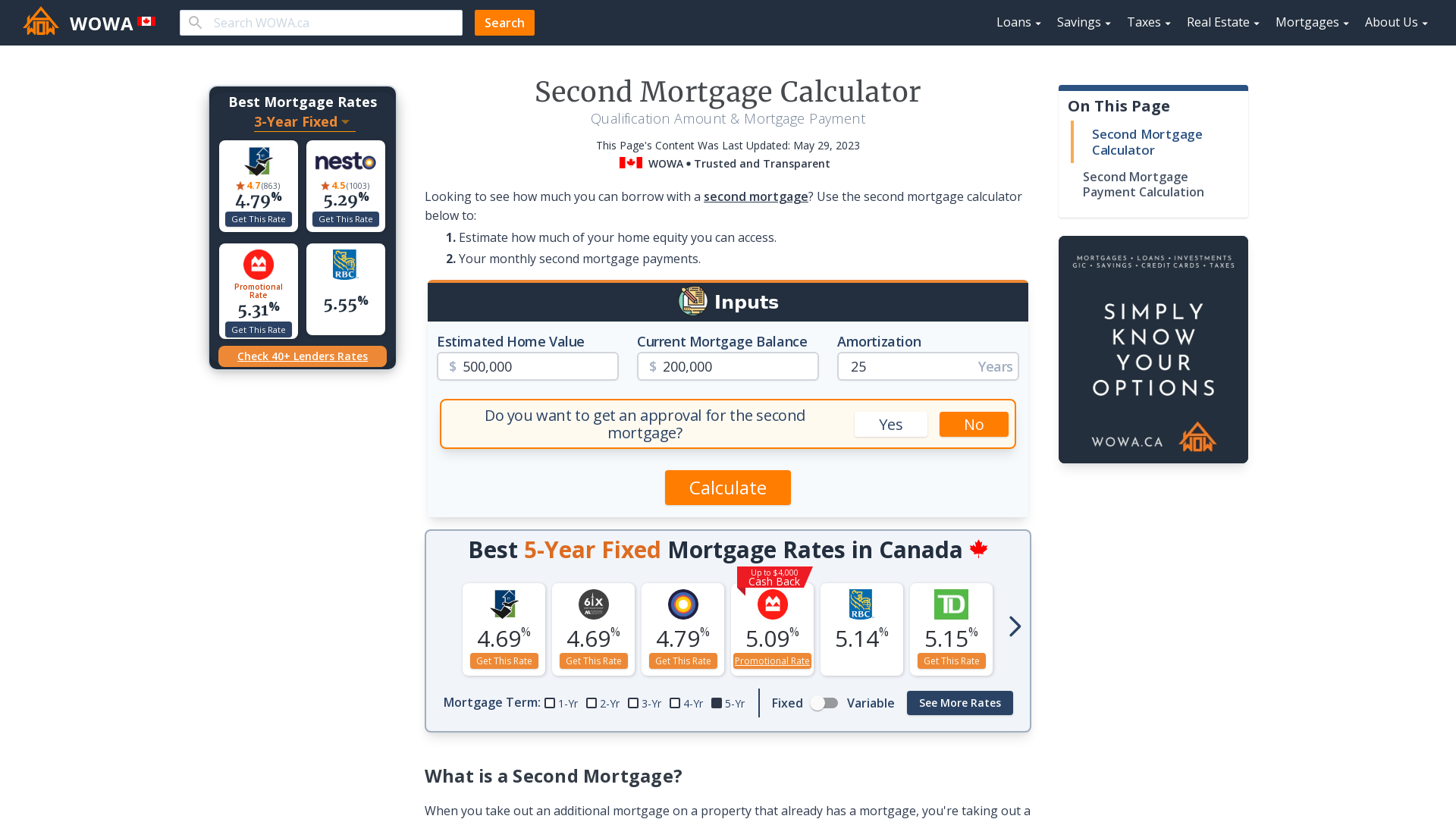

Second Mortgage Calculator Qualification Payment Wowa Ca

Mortgage Do S And Don Ts Mortgage Mortgage Tips Mortgage Advice

What You Need To Know About 401 K Loans Before You Take One

Use Our Mortgagecalculator To Help You Set Your Budget Price Your Payments See How Making Additional Paym Home Buying Tips Mortgage Calculator Calculators

Can A Personal Loan Can Save You Money Personal Loans Reverse Mortgage Loan

Guide To Getting A Mortgage In 4 Steps Meridian Credit Union

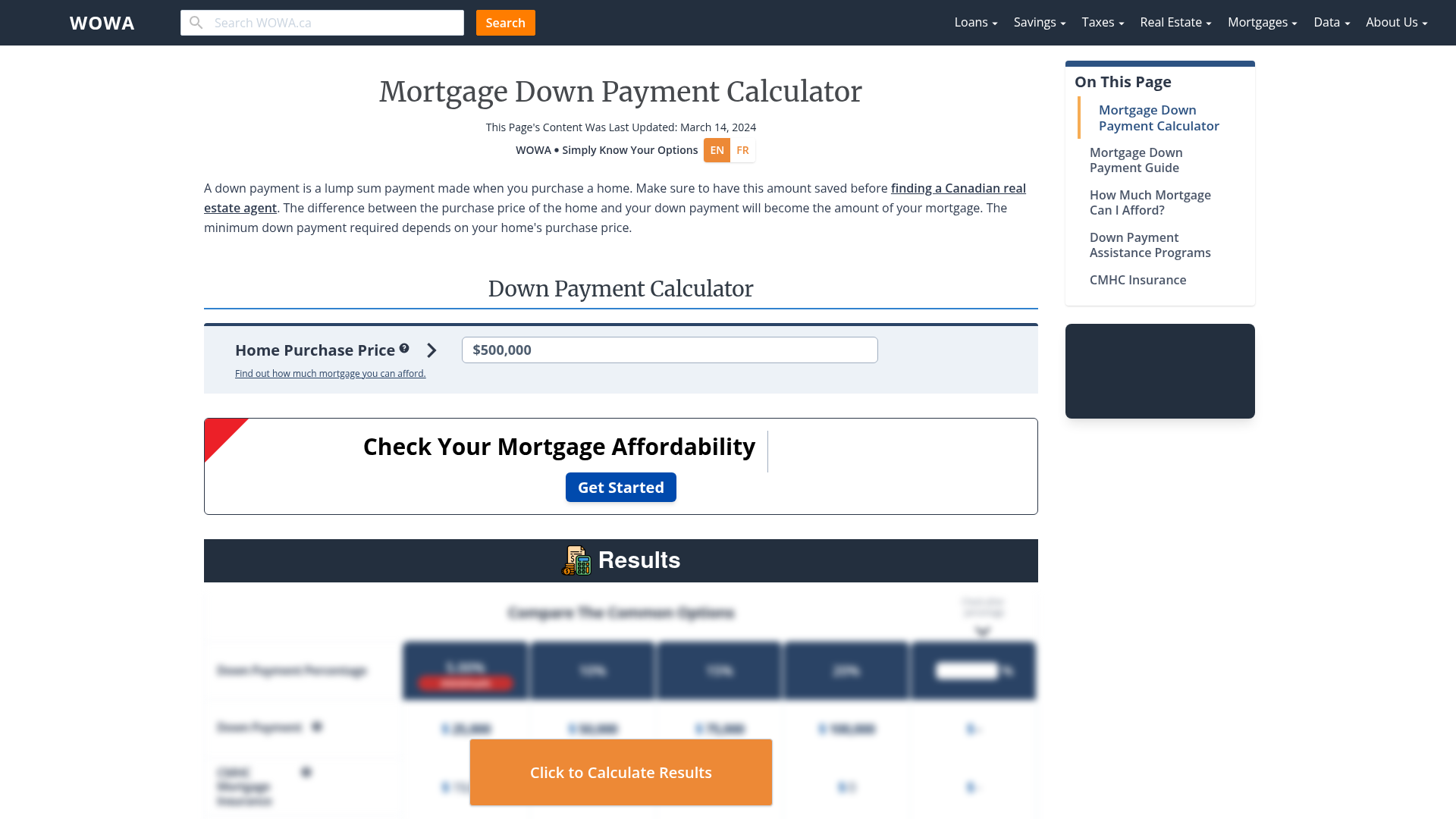

Mortgage Down Payment Calculator 2022 Mortgage Rules Wowa Ca

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

Why Be Preoccupied With What We Can T Achieve For The Time Being When We Can Become What We Can Live With Effort And Persistence In 2022 Persistence Achievement Effort

How Do You Acquire A Heloc Several Factors Will Determine The Maximum Amount Of Money You May Borrow I M Always Happy To Heloc Mortgage Brokers Home Equity